Frequently Asked Questions

Can't find the answer? For assistance, please email phillysupport@charities.org or submit your question at www.charities.org/support.

Campaign Basics

1. What is the Combined Campaign?

The City of Philadelphia Employees’ Combined Campaign is the City’s workplace giving program. The Campaign gives employees and retirees the opportunity to contribute to pre-approved charities using the convenience of payroll deduction, credit card, and personal check. Simply put, through this Campaign, you can positively affect your community.

2. Who is America’s Charities?

America’s Charities, which inspires employees and organizations to support each other and the causes they care about, is Philly's Campaign Management Organization (CMO). The CMO administers the Campaign and works with Campaign Captains to develop ideas and implement plans to promote the Campaign. Becky Marx is the Project Manager: bmarx@charities.org.

Campaign Participation

3. When does the Campaign launch?

The Campaign launches October 28, 2024 and ends November 29, 2024.

4. Are employees required to participate?

No. This annual charitable giving program is purely voluntary and a personal decision; however, one of the City’s core values is to give back to local communities. The Campaign is a manifestation of those values because it provides employees and retirees with an opportunity to make a collective impact.

5. Is the giving portal open all year?

No. The giving portal will be open for active pledging from October 28-November 29, 2024.

6. Can I donate to any nonprofit organization?

City employees and retirees may choose from more than 300 charities, all eligible for donations. View the Contributors’ Guide here for a list of all causes and their charity codes. If a charity is not in the Contributors’ Guide, please contact Campaign Manager Becky Marx: bmarx@charities.org

7. Is there a limit to how much or how little I can pledge?

The City-mandated minimum donation amount for all payment methods--payroll, electronic check, and credit card--is $52 total, per charity, annually. This equates to a $2 per pay period payroll donation for employees on a 26 pay period cycle.

8. If I do not feel comfortable entering my information on the web, is there another way for me to make a pledge?

Yes. You can make your pledge by completing the pledge form, found here on the giving portal. Once complete, email the form to phillypledges@charities.org. Follow the instructions on the pledge form to ensure proper processing.

9. Whom do I contact if I have a question not listed here?

Please contact America's Charities Donor Services Help Desk by emailing phillysupport@charities.org or submitting your question at www.charities.org/support.

Ways to Give

10. How do I donate?

There are two ways to donate online: online and by pledge form. Click here to go back to the giving portal homepage, then click "Donate Now" to begin the online giving process. Or, you can access the pledge form on the top navigation of the site. You can access step-by-step giving instructions in various formats here.

11. What payment methods are accepted?

NOTE: There is an annual minimum donation of $52 total per charity for all payment methods: payroll deduction, credit card, and check.

Recurring Payroll Contribution: The minimum donation is $2 per pay period, or $52 total annually, per charity. Payroll contributions will automatically start with the first pay period in 2025.

One-time Debit/Credit Card Contribution: You must donate a minimum of $52 total per charity. All debit/credit card transactions will incur a per-transaction fee of 3.5% by your carrier. Credit card transactions are immediate. In the event of an error, you will need to contact your credit card company to cancel the transaction.

One-time Electronic Check Donation: You must donate a minimum of $52 total per charity. Be sure to check the box at the bottom of the payment screen to authorize the transaction.

12. How do I find charities to support?

Click "Donate Now" on the homepage. After you select the dollar amount you would like to give, click "Continue" and you will arrive at the Charity Picker. On this screen, you will find a search bar where you can enter the charity name, federation, city, or state to find a charity to support. Click here to access the step-by-step instructions for all payment methods.

13. How do I cancel a donation?

Email your requests to cancel pledges made online or by pledge form to phillysupport@charities.org, and copy Becky Marx at bmarx@charities.org. However, please note that debit/credit card transactions are immediate. If you would like to cancel a debit/credit card pledge, please contact the America's Charities Donor Services Help Desk for assistance at phillysupport@charities.org or www.charities.org/support.

Payroll Deduction Benefits

14. Why should I give through payroll deduction when I can send a check directly to the nonprofit(s) of my choice?

Payroll deduction is a much more efficient, economical way for a nonprofit to process the gift. America's Charities, the Campaign Management Organization, aggregates contributions before disbursing, so nonprofits process one regular payment rather than hundreds or even thousands of individual checks. Even donations directly on a charity's website costs charities more time, energy, and resources than it does for a funds processor to do all the back-end work. Processing individual donations drive up administrative expenses for nonprofits.

Additionally, it is easier to make larger contributions through payroll deduction than by check. You can give as little as $2 per pay period to each charity through payroll deduction -- so you're not breaking your bank while you make a big impact, which also allows nonprofits to plan for strategic impact all year long. Most people find foregoing the cost of a soda each paycheck is easier on their budgets than writing a single large check. For example, you can give $260 to one of your favorite charities with just a $5 weekly donation via payroll deduction, which goes that much farther for the charities tackling our world’s greatest problems.

15. Are my contributions tax-deductible?

Yes, your payroll contributions are deductible for the 2024 tax year. One-time credit card and check contributions are deductible for the 2023 tax year.

Affordability

16. What if I can’t afford to give enough to make a difference?

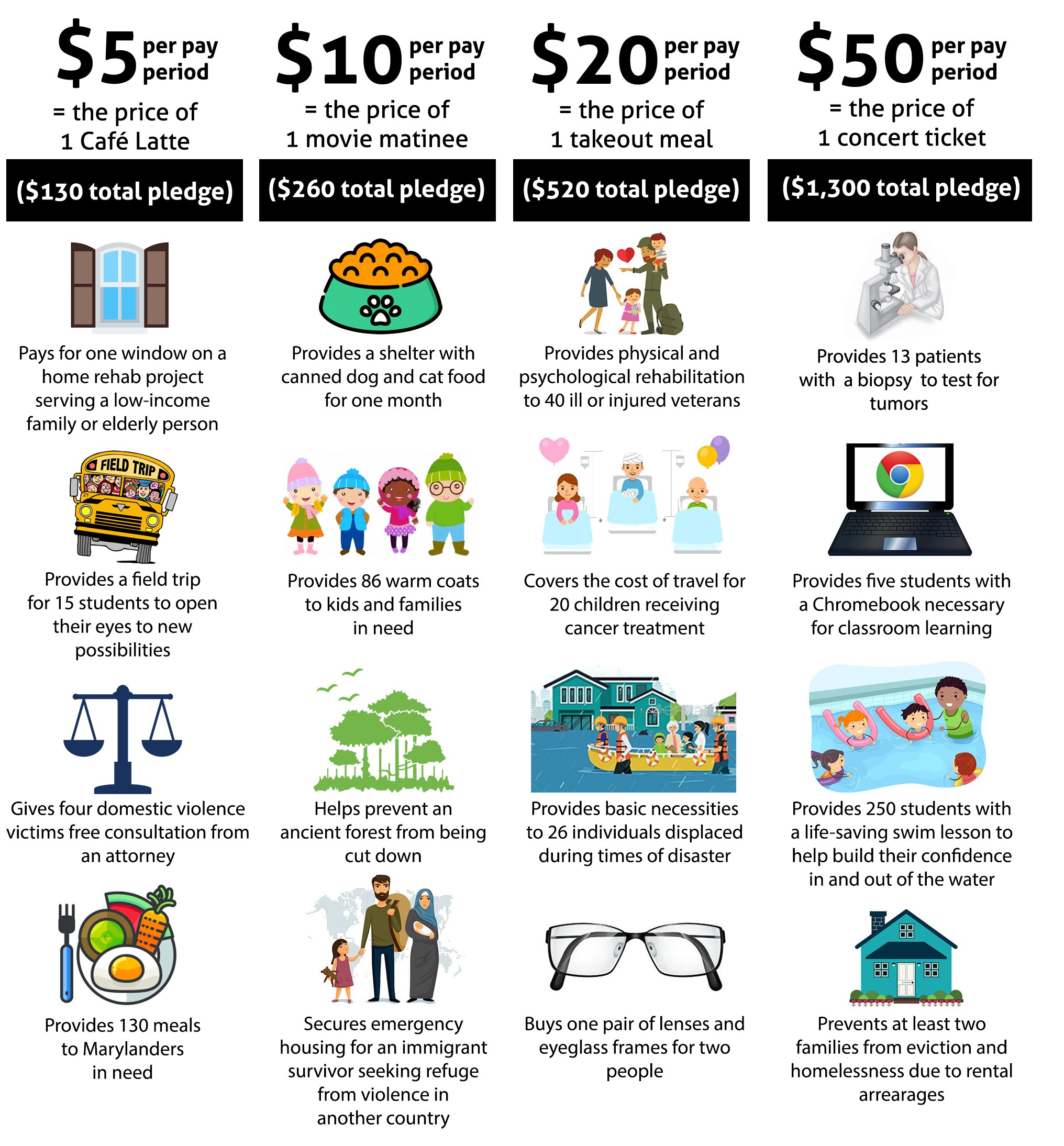

Did you know that the majority of charitable giving in the U.S. (approximately 72%) is a result of generous individuals like you? Especially now - when demand for charities' services has surged, just as their resources have dwindled -- every single penny matters. We gave spoken to hundreds of charities and all of them have said, "No gift is too small." In fact, we asked charities what they can do and turned their answers in the infographic below. Every penny matters; each cent goes a long way to help the most vulnerable among us.

Whatever you can do, we, and the charities participating in the Combined Campaign, are grateful.

Click graphic to open an expanded view.